Becoming part of the freelancing world or the gig economy, where workers are involved in temporary or on-demand job, comes with challenges how to budget with irregular income. Business instability may hit anyone. If unprepared, monthly expenses can be higher than income. However, with the right approach, it is even possible to save money through planning. Now it’s time to become a detective to investigate what expenses consume most of your budget. These freelance finance tips can help you budget effectively.

Table of Contents

- Calculate and Record Your Basic Expenses

- Become a Detective of Expenses to Learn How to Budget with Irregular Income

- Have a Financial Plan

- Build a Fund or Better 2

- Say No to Lifestyle Creep to Cope with Irregular Income Budgeting

- Pay Yourself First

- Adjust Your Budget Monthly and Plan for Lean Months

- Diversify Your Income Streams

1. Calculate and Record Your Basic Expenses

The first and the most important step in budgeting is to research your expenses. You can categorize them based on two broad categories:

- Essential

- Non-essential.

Essential expenses are definitely those that you should pay every month in any case like housing, transportation, food, medical insurance, medications, and utilities. Look at your bank statements and write down essential expenses which you cannot skip. They can be your general monthly expenses. Using the Japanese approach to saving money, expenses include general, non-essential, unpredictable, and cultural. This method is called Kakeibo.

Non-essential expenses are those you can skip occasionally like clothing, presents, gym membership, and entertainment.

Kubin and Wentworth (2014) have offered a more detailed classification into fixed, variable, and periodic types. Fixed expenses result from the need to pay under signed contracts like rental payments, etc. Variable expenses are those you can change like buying cheaper food or going on foot when possible in case of short distances instead of driving and spending on the car. Periodic expenses are rather seasonal expenses. For example, you may need a car warranty or may spend money on repairing or maintaining the car, house items, etc.

Steps to Calculate Your Expenses:

- Analyze your monthly bank statements for several months;

- Categorize your expenses into several categories with the emergency fund for saving;

- Calculate the minimum monthly amount of money you need by adding essential expenses.

2. Become a Detective of Expenses to Learn How to Budget with Irregular Income

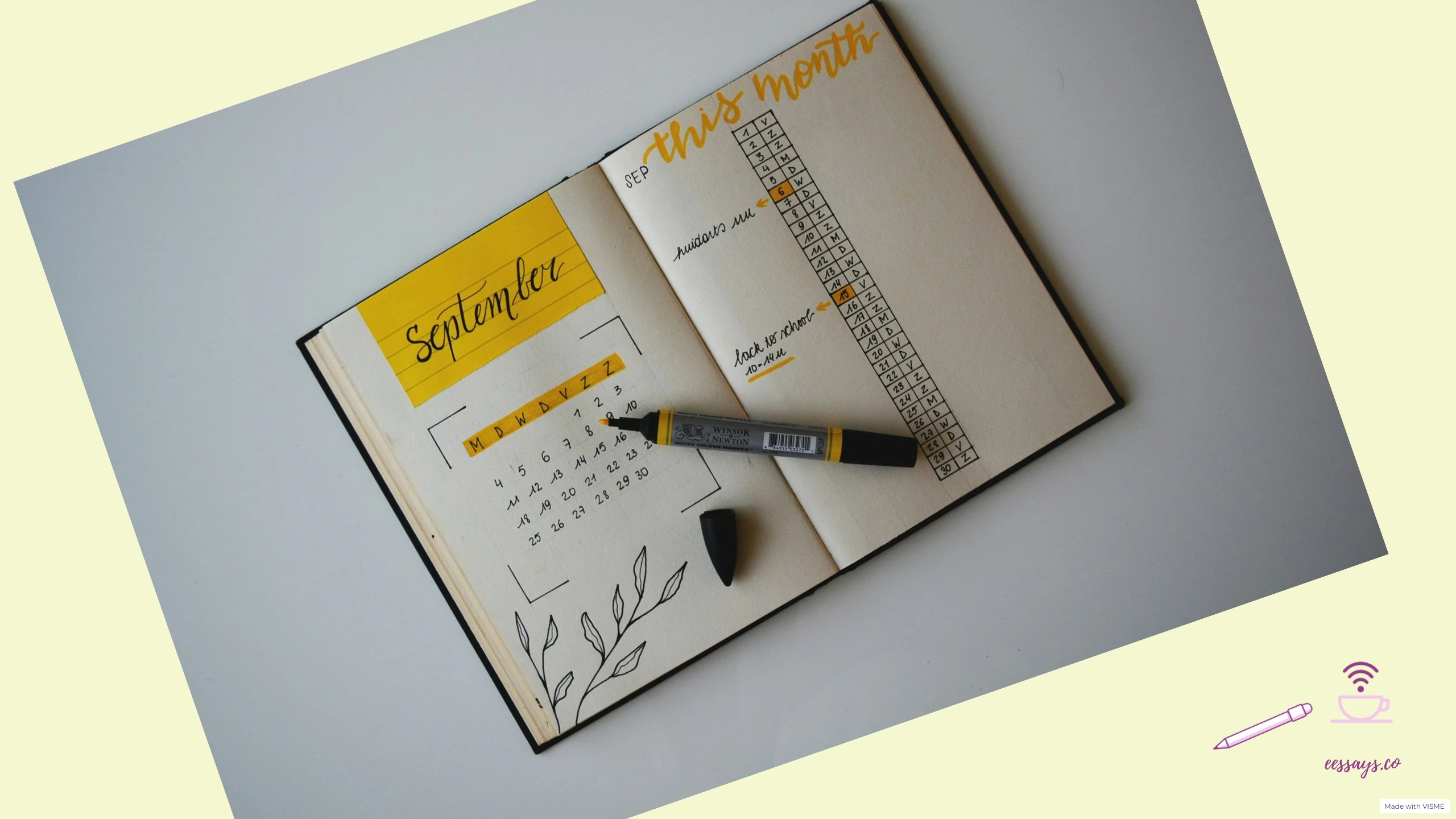

Track your income and expenses regularly. You may start with investigating where your money flows each month and then weekly.

You may use the date you get your payment and then track expenses for a month from this date.

For example, you get payment from Google Adsense for ads on your blog on the 22nd of each month, so you can start tracking weekly expenses from this date. In other words, you have this sum for the next 4 weeks.

Tools to use:

- Excel: enter Month 1 to 12, then categories of expenses, total expenses for 12 month, and calculate the average based on 6 or 12 months.

- Banking app statements: check statements in the banking app to detect categories of expenses.

- Automatic payments: you can choose such option to pay all essential expenses and then to plan how to use the sum left according to your financial plan.

3. Have a Financial Plan

As it is evident from the discussion above, create your budget or financial plan based on prioritizing various categories of expenses.

Monthly financial plan is a short-term plan reflecting the flow of your personal money during a month. It should start with essential expenses you pay monthly:

- Housing

- Emergency fund: no matter what happens, you should save a certain sum in your emergency fund (determine the fixed amount like 10% from your income each month)

- Debt

- Essential but variable: food and care items

- Planned periodic expenses like gifts, repairs and maintenance, clothing

- Culture expenses, which may relate to books, theater, cinema, museums, etc.

- Fund for UNPREDICTABLE EXPENSES: since your income is irregular, determine the percentage of money (like 10%) you save from each income for each next month.

TIP: Save a small sum left for unpredictable expenses next month.

4. Build a Fund or Better 2

CREATE 2 funds: EMERGENCY FUND and UNPREDICTABLE EXPENSES fund.

The first is a fund for long-term use in the future far from now like in case you will have no income for several months.

The second one is a BUFFER FUND to cover the difference between variable income each month.

In other words, the emergency fund is for saving a fixed sum of money and forgetting about it till some period in the future, while the unpredictable expenses or buffer fund is used throughout the year, depending on differences in income each month or on unpredictable events.

Steps to create a fund:

- Automatic option to save the fixed sum or percentage for each fund monthly,

- Postponing periodic expenses for a month with higher income.

5. Say No to Lifestyle Creep to Cope with Irregular Income Budgeting

Irregular income budgeting comes with various challenges, and lifestyle inflation is one of them.

Lifestyle creep or inflation is a phenomenon that happens to a person starting to increase their expenses along with earning more.

Sometimes, it happens you start buying more expensive clothes or simply more of something you do not need. However, it is always important to be a conscious consumer not to be trapped in lifestyle creep. Simply follow these steps:

- Always ask yourself whether you need and will use the item you buy regularly

- Think whether the product will bring benefits to your health

- Avoid overspending and do not shop on impulse

- Allocate the money you saved as a result of conscious consumption to your Emergency and Buffer funds

6. Pay Yourself First

Make your financial health a priority.

Again, you should start managing your finances with allocating 10% of income to the Emergency and Buffer or Unpredictable Expenses Funds. Although it may seem that the emergency fund is for unpredictable expenses too, but make it a fund for your healthy financial future. It may be used when you will need housing or expenses when retired.

Use a buffer or unpredictable expenses fund to cover unpredictable income or additional expenses.

The method to pay yourself first means that you should first allocate money to your own funds and then pay to other parties.

7. Adjust Your Budget Monthly and Plan for Lean Months

One of the important freelance finance tips to learn how to budget with irregular income is to review your budget regularly and make necessary changes.

First, you should calculate your average income on a Yearly, Monthly, Weekly, and Daily basis. Then, calculate your average essential Yearly, Monthly, Weekly, and Daily expenses. Afterwards, you can create a financial plan based on the sum left and adjust your budget based on this amount only.

Adjust your expenses and prepare for lean months by means of buying non-perishable products during high-income months.

8. Diversify Your Income Streams

Think of making your money work for you by means of investments:

- Study how to invest to get dividends

- Invest your time in creating digital products

- Set the goal of increasing income without constant work like by means of writing a book or selling a course

- Take additional projects as a freelancer for additional income

Always aim to earn more for the time you invest.

Following these steps will help you ensure your financial health and face any unpredictable situations.

Detect all your expenses, pay for yourself and essentials first, and think of investment options. As a result, you can be confident in the future through thinking strategically.

Reference

Kubin, L., & Wentworth, G. (2014, September). Living on an irregular income. Colorado State University. https://extension.colostate.edu/docs/pubs/consumer/09157.pdf

Leave Your Feedback